Time isn’t on your side. You’ll work and save your entire life to reach retirement. But as you age, your likelihood of death within the next ten years goes up.

By the time you reach retirement age, your chances of dying within ten years hit 30%. You need to prepare for that eventuality. Do you really want to roll the dice on your retirement savings?

The best way to ensure your retirement goes to your loved ones instead of the government is through an IRA beneficiary designation trust. Today we’re going to cover what that means and why exactly you need one. Let’s dig in.

1. What in the World is a Beneficiary Designation Trust?

If you were to leave your entire life savings to one person who would it be? What happens if they die? Do you have anybody else?

Commonly, you’d assume that your beneficiary would and should be a person. But this isn’t always true. You can leave your IRA savings to an (almost) immortal trust.

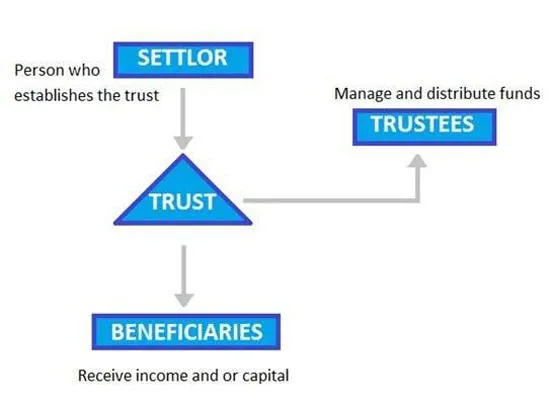

A trust is a third-party financial agreement. It’s something people use to control their wealth, protect their assets, and keep certain aspects of their financial situation private.

You can specify the terms of most trusts designating to whom your assets go and when. You can set up a trust that keeps your assets accessible in your lifetime and then passes access to another person. The third party is often a bank, a board of trustees, an attorney, or all three.

An IRA beneficiary trust is a trust you create to specifically control your retirement savings after you die.

2. The Rules of a Non-Person Beneficiary

If you’re not naming a person as your beneficiary, you will have to follow slightly different rules. For example, since the trust is essentially immortal, the final beneficiaries can’t use the life expectancy method to determine post-death pay-out if the owner dies before the required beginning date.

If that happens, your trust must disperse funds within 5 years rather than over the lifetime of the named beneficiaries.

- The trust must be valid and under state law.

- It’s an irrevocable contract (often, this becomes true at the owner’s death).

- The trust must name identifiable beneficiaries.

- To begin dispersing funds, whoever is in charge of the trust must provide documents to the IRA custodian by October 31 following the IRA owner’s death.

3. Why a Trust Instead of a Person?

Someday, you might be the rich uncle or aunt stereotype. If you are going to acquire a large amount of wealth or you suspect you will, a trust might be a good option.

Ask yourself this, do you trust your relatives (or friends) to spend your retirement savings wisely? It’s a tough question because you want to trust your relatives or friends. But some people just burn a hole in their pocket with money.

A trust gives you the peace of mind that your IRA savings will go toward what you want. For example, if your child or nephew or niece will eventually go to college, you can designate funds go directly to education.

If you’ve been through multiple marriages and your children are with different people, you might want to disperse funds accordingly. A trust will allow you to name both your current spouse and their children and your previous spouse and their children.

One such trust is called a qualified terminable interest property trust.

Be Sure Everyone is in Agreement

A beneficiary designation trust could be an effective wealth-planning tool. But be sure everyone involved, including the trustees, the attorney, and the IRA custodian all agree on the provisions and laws surrounding the trust.

If they don’t agree, the process will become long and more complicated than it needs to be. If you need help setting up an IRA trust, contact us. We’ll make sure everything works out in your favor.