3 Outstanding Benefits of a Revocable Living Trust

Understanding Your Options: 3 Outstanding Benefits of a Living Trust

Creating a revocable living trust is a great way to start your estate plan. Learn more about the benefits of a living trust and how it can help your estate.

Keyword(s): benefits of a living trust

According to Forbes magazine, over half of all Americans do not have estate planning in place.

The end of life is inevitable and it is important that you plan for it. However, it can be difficult to decide how you want to handle the transfer of your assets to your beneficiaries.

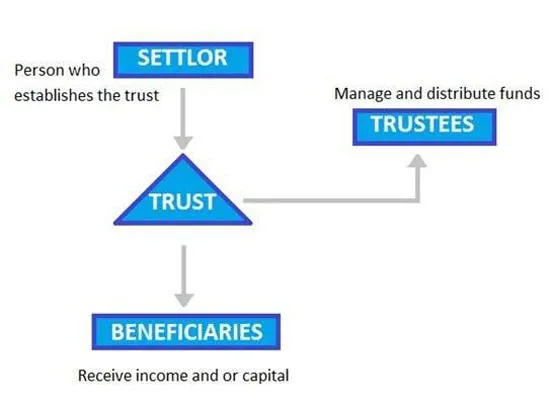

If you have been considering getting a revocable living trust to handle your assets, then it is a good choice. This is because it allows for a smooth transition of your assets when you pass away.

A revocable trust is speedy, secure and difficult to contest. If these benefits seem like just what you were looking for then read on to fully understand the benefits of a living trust.

1. Avoid a Probate

One of the best benefits of a revocable living trust is that it avoids probate once you have passed on. Whenever a will is made to distribute your assets, it will have to go through the courts upon your death.

After the probate, your assets will be distributed to your beneficiaries according to the stipulations in your will. Probate for a will can last months and sometimes years.

However, a living trust will see your desired beneficiaries getting hold of the assets you want them to have quickly through the help of a trustee. Sometimes, in a matter of weeks after your death.

2. Protection of Assets Should You Become Incapacitated

One of the major benefits of a living trust is asset protection should you become mentally or physically incapacitated. This is different from a will which only looks to protect your assets at death.

When you set up your trust you can even set up the guidelines for how your mental incompetence will be determined. You can specify that your doctor or a team of doctors be consulted to make this judgment.

Once you get a diagnosis of incompetence, your successor trustee will step in and take over the duties involved in managing your estate.

3. It’s Harder to Contest

Do you anticipate that people will be unhappy with how you choose to distribute your estate? If your answer is yes, then a living trust will provide you with protection.

A living trust requires your ongoing participation. You will need to transfer funds and property to the trust in order to fund it.

This is usually done when you are in good health and a sound frame of mind. This makes it harder to challenge your competency upon death, thereby making it harder to contest a living trust.

Final Thoughts on the Benefits of a Living Trust

The benefits of a living trust give you peace of mind and this is what makes it a wise choice for estate planning. The last thing you want is for your desired beneficiaries to have to go through a lot of issues when the times comes for them to receive benefits.

When you create a living trust you make the transition of your estate a smooth process for your loved ones. You also protect them from anyone who might want to contest your final wishes.

If you would like more information on managing your estate, please contact us.